| | Housing Market |  |

|

|

| Author | Message |

|---|

Xeos

Officer

Posts : 880

Join date : 2007-12-10

|  Subject: Housing Market Subject: Housing Market  Fri Jan 23, 2009 9:54 am Fri Jan 23, 2009 9:54 am | |

| I understand that every area's housing market is different. In general what do you guys think or have read/heard about where housing market is going to go from here?

In my area ANY home <200,000 that is 2000sq ft+ and <10 years old is being listed and then pending within 2 days. This trend makes me believe that it is not going to drop anymore than it is, or if anymore very little (not the 50% price drop that we have had in the past 2-3 years).

Reason I am asking is because I am looking about buying another house in the market. Interest rates are good right now so even if housing prices drop another 5kish but the interest rates go up it is a wash. Just checking all around to make sure noone knows something that I don't.

Last edited by Xeos on Fri Jan 23, 2009 1:25 pm; edited 1 time in total | |

|

| |

Necis

Officer

Posts : 466

Join date : 2007-12-12

|  Subject: Re: Housing Market Subject: Re: Housing Market  Fri Jan 23, 2009 10:05 am Fri Jan 23, 2009 10:05 am | |

| From my point of view being a construction worker, I have heard no news of an increase in the home building market. I would say we will have a pretty level market for the next 6 or so months. I am basing this solely on my experience with the housing market as it relates to the general activity of construction. Of course I am in the midwest and so the market here will be much different than the silliness that goes on at the coast. | |

|

| |

Honed

Posts : 225

Join date : 2008-09-12

|  Subject: Re: Housing Market Subject: Re: Housing Market  Fri Jan 23, 2009 10:18 am Fri Jan 23, 2009 10:18 am | |

| In our area we are still seeing a significant drop in the housing market. A lot of this has to do with the fact that NY was one of the last states to declare a recession and we are probably 6 months behind the times. Nonetheless we are also looking for an investment property and are still seeing drops. Obviously a huge amount of these properties are banked owned short sales but they are even willing to negotiate do to the climate.

That being said, every friend or family member I have involved in real estate is pushing me to buy now simply b/c of the interest rates. Most are motivating with exactly what you said, even if the house drops, the rates will go up and it will become a wash. | |

|

| |

Xeos

Officer

Posts : 880

Join date : 2007-12-10

|  Subject: Re: Housing Market Subject: Re: Housing Market  Fri Jan 23, 2009 10:36 am Fri Jan 23, 2009 10:36 am | |

| I have heard the same thing Honed but I have to think of what anyone in real estate's bottom line is, sales. Good bad or indifferent I don't think the lenders or the agents will ever tell you exactly the truth, they just want to keep selling so that they can make a living themselves.

And to be clear a Bank Owned home and a Short Sale are two very different things. I am looking at bank owned homes that are turning in approx 72 hours. Short Sales are where the previous owners still own the home, but the bank has agreed to let them sell it for less than what they owe and the seller has negiotiated out some forgivnence in the difference. Short Sales typically can take 90 days. The banks are flooded with people trying to sell their homes at appraised value but less than what is owed and they are taking forever just to get back to offers in order to counter-offer them. Even when a price is agreed on it then has to go to another guy at the bank who can "veto" the agreement and yo ahve to start over again from scratch.

TLDR - Real Estate Agents are liars, Short Sales Suck Donkey Balls | |

|

| |

Honed

Posts : 225

Join date : 2008-09-12

|  Subject: Re: Housing Market Subject: Re: Housing Market  Fri Jan 23, 2009 11:21 am Fri Jan 23, 2009 11:21 am | |

| Two things, first there was meant to be a / in b/t bank owned and Short sales. Second I am talking about people in my family and/or my closest friends, not random brokers/agents. I am also in sales and while yes I want everyone to believe business is great I certainly would expect those closest to me to trust what I say. Where else would you get your information from? An internet forum??  | |

|

| |

Vaslant

Posts : 558

Join date : 2008-08-01

Age : 39

Location : H-TOOWWWN!

|  Subject: Re: Housing Market Subject: Re: Housing Market  Fri Jan 23, 2009 12:25 pm Fri Jan 23, 2009 12:25 pm | |

| - Honed wrote:

- Obviously a huge amount of these properties are banked owned short sales but they are even willing to negotiate do to the climate.

My house was a pre-foreclosure short sale. Got 2k+ sq. ft., 4bdrm/3bath for $95k. Built in 2005. In a HOA w/ a small-ass backyard, but compared to everything else we looked at, for the house only being 3 years old at the time and in near-mint condition, we couldn't pass it up. Property tax rate isn't terrible either. Gotta love ESCROW. Honestly, not a bad deal, but it sure would have been nice to been in a position to negotiate since there were some flaws. I've already spent over $1k in repairs in < the first year since the bank was not in a position to cover anything. "As-is" is always something to beware of, which is why we invested $200 before we bought the house to have an inspector come out and check everything out. He gave us a nifty 3-ring binder with pix and detailed problem areas. The assurance was well worth that $200. - Honed wrote:

- Where else would you get your information from? An internet forum??

Isn't this r/l? What is this "internet" you speak of? @ Xeos: It took over 90 days for us to close out. The bank was being all nonchalant about the situation and acted like they didn't care if it took years to close on the house. We got good financing too. It always helps to know people in certain areas of business. Our note, including insurance + ESCROW is only $880/mo. Only $100/mo more than the 1 bdrm apartment we moved out of and into the house. This house costs less than most 2 bdrm apartments in Houston right now. ~ Sean | |

|

| |

Xeos

Officer

Posts : 880

Join date : 2007-12-10

|  Subject: Re: Housing Market Subject: Re: Housing Market  Fri Jan 23, 2009 12:32 pm Fri Jan 23, 2009 12:32 pm | |

| - Vaslant wrote:

- Got 2k+ sq. ft., 4bdrm/3bath for $95k. Built in 2005. In a HOA w/ a small-ass backyard, but compared to everything else we looked at, for the house only being 3 years old at the time and in near-mint condition, we couldn't pass it up. Property tax rate isn't terrible either. Gotta love ESCROW.

God what I would give if housing in California went for that. And Honed I know, family friends have told me too and yes I am using a forum. Trying to use all options available to me. Appreciate the input. | |

|

| |

Vaslant

Posts : 558

Join date : 2008-08-01

Age : 39

Location : H-TOOWWWN!

|  Subject: Re: Housing Market Subject: Re: Housing Market  Fri Jan 23, 2009 12:44 pm Fri Jan 23, 2009 12:44 pm | |

| At least we're not having to deal with this... http://www.khou.com/news/local/galveston/stories/khou090121_mp_open-house-galveston.1953a7c1.htmlGalveston is STILL destroyed, this far past Hurricane Ike. At least we have a market, I suppose. They don't even have businesses running to support homeowners there. Speaking of, I wonder if our Galveston refugees went to New Orleans to try to start a new life... I'll never forget you, Katrina. You filled my life with some lulz.  Opening our arms to let them come over and try to start a new life... brought Texans more than they bargained for: http://www.mysanantonio.com/news/MYSA110106_Rodriguez_2d8cd00_html4457.html - Trina Boone wrote:

- "To be honest, they selling a lot of weed."

I lol'd. ... I srsly doubt if any Galvestonians fled to New Orleans, but if they did and if there was an increase in crime, we would've heard about it on the news: "46 y/o Man brings fishing pole to a gun-fight!" or "Surfer robs liquor store at board-point." ~ Sean

Last edited by Vaslant on Fri Jan 23, 2009 12:54 pm; edited 3 times in total | |

|

| |

Honed

Posts : 225

Join date : 2008-09-12

|  Subject: Re: Housing Market Subject: Re: Housing Market  Fri Jan 23, 2009 12:51 pm Fri Jan 23, 2009 12:51 pm | |

| $880?? Damn that's awesome for what sounds like a nice place! Where do you live again? Move over ahm sleepin in ur bedz! | |

|

| |

Vaslant

Posts : 558

Join date : 2008-08-01

Age : 39

Location : H-TOOWWWN!

|  Subject: Re: Housing Market Subject: Re: Housing Market  Fri Jan 23, 2009 12:53 pm Fri Jan 23, 2009 12:53 pm | |

| - Honed wrote:

- $880?? Damn that's awesome for what sounds like a nice place! Where do you live again? Move over ahm sleepin in ur bedz!

Tomball, TX. And we're not using the 3 bdrms upstairs atm for anything but storage, so we have PLENTY of space.  Also, I edited my previous post if you're bored.  ~ Sean | |

|

| |

Kamma

Posts : 378

Join date : 2007-12-09

|  Subject: Re: Housing Market Subject: Re: Housing Market  Sat Jan 24, 2009 6:07 am Sat Jan 24, 2009 6:07 am | |

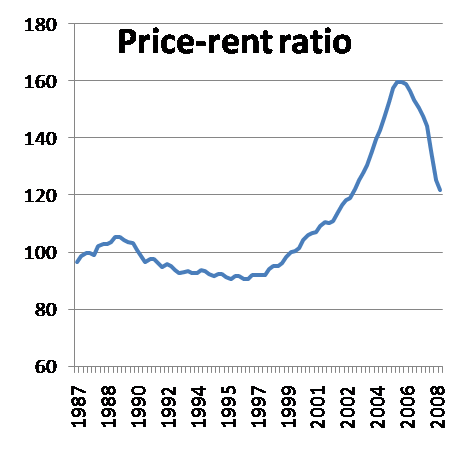

| Here's a quick snapshot of a measure of housing market fundamentals; the price-rent ratio is a great deal like a price-earnings ratio for stocks. P/R ratio = Price / Annualized Rent. This is from an October post on Paul Krugman's blog. The scale is off, the P/R is usually in the 15-30 range... But, you can at least glean current trends relative to the long run average.  This chart suggests that as of 3.5 months ago prices had not come in line with the long run average P/R (maybe two thirds of the way to equilibrium). Here is a paper from two NBER economist analyzing the fundamentals of the housing market. The jist of it is that housing prices are historically driven by real interest rates. It sort of states the obvious, but they run some nice regressions on the data to look at that relationship concluding that - Quote :

- Consensus forecasts from the futures markets and various Wall Street

analysts predict additional declines in house prices of 15 percent or more over the

next 18 months. Consistent with the asset-pricing model presented earlier,

lowering mortgage rates by nearly one percentage point would raise housing

demand by about 10 to 17 percent, blunting the projected price declines. I.E. If real interest rates fall by about 1%, the housing market should stabilize. However, note today's headline: 30-year fixed rates climb back above 5%. So, at least in a big picture sense, I wouldn't expect a bottom for at least another 2 quarters (a conservative prediction). Of course, housing markets are very regional and I have read articles (which I cannot find right now) which speculate that the California market will bottom out first. Your best bet is to look at local mortgage rate trends and P/R ratio trends -- they are the cleanest ways to get a sense of housing market fundamentals. | |

|

| |

Kamma

Posts : 378

Join date : 2007-12-09

|  Subject: Re: Housing Market Subject: Re: Housing Market  Sat Jan 24, 2009 9:12 am Sat Jan 24, 2009 9:12 am | |

| I took the Housing Price Index for California published by the BLS (created by the OFHEO) and the rental rate components of the CPI for the greater SF and greater LA areas to create the following P/R chart:  Which is simply HPI / CPI rent component (nothing seasonally adjusted -- I just used raw levels). The base year (=100) for the HPI is 1980, and for both CPI rent components is 1982. So, simply multiply the ratio by the average home price in 1980 and divide by the average (annualized) rent in 1982 to get a sense of the proper scale. Unfortunately, I don't have those numbers at hand. The final quarter in the data series is the 3rd quarter of 2008. Noting the possible upwards trend in the troughs in the LA series, one could argue that things might bottom out anywhere from 1.2-1.5. Considering that the final data point is from July, and the significant momentum to the price decline, we may be getting close to the bottom by now. However, there is still a good deal of momentum to the California housing market. There is the possibility of over shooting the long run P/R. I'll revise my speculation. If interest rates go up much further, I'd expect at least 2 quarters (maybe more like a year) to the bottom. If interest rates fall (for example, one plan flying around Washington is for the gov't to finance 4.5% fixed rate mortgages), the P/R could bottom out within the next 2 quarters. Basically, we should be entering reasonable P/R levels by now. How far we go into that range depends on interest rates and public policy. | |

|

| |

Sponsored content

|  Subject: Re: Housing Market Subject: Re: Housing Market  | |

| |

|

| |

| | Housing Market |  |

|