|

| | | Per our earlier conversation... (kamma, secondary) |  |

| | | Author | Message |

|---|

- Z -

Posts : 2012

Join date : 2007-12-09

Location : Surrounded by primitive screwheads

|  Subject: Per our earlier conversation... (kamma, secondary) Subject: Per our earlier conversation... (kamma, secondary)  Mon May 26, 2008 2:16 pm Mon May 26, 2008 2:16 pm | |

| | |

|   | | Kamma

Posts : 378

Join date : 2007-12-09

|  Subject: Re: Per our earlier conversation... (kamma, secondary) Subject: Re: Per our earlier conversation... (kamma, secondary)  Mon May 26, 2008 7:53 pm Mon May 26, 2008 7:53 pm | |

| His claims are misleading. Specifically, his main point that - Quote :

- There will and must be many more such booms, for without them the economy of the United States can no longer function. The bubble cycle has replaced the business cycle.

is rather odd. People in our day and age are spoiled, and think that anything but the relative calm in macroeconomic variables which we have enjoyed in the last fifty years is a grave departure the natural state of affairs. Cycles in fact, are the natural occurrence. To see what I'm getting at a plot of inflation in the UK suffices. Follow this link, uncheck "US", type 1265 and 2007 in the boxes, hit enter, then hit the link "Plot Series." Examining the graph, you can very clearly see how UK inflation/deflationary cycles were common and wide up until the great depression. After which, deflation never occurred again, and inflation was kept under control except during the late 70's (by under control I mean generally less than 5%). (Edit: it should be noted that the rise of inflation in the 70's was largely due to severe oil price shocks to the world economy and the inadequacy of monetary theory at the time. The Phillip's curve was considered to be a stable relationship, which it now is understood as undergoing various shift factors - inflation expectations and marginal costs (see this.) He says - Quote :

- Bubbles were once very rareóone every hundred years...

No, sir. You are wrong. Stop being spoiled by the massive advances in monetary theory which have occurred over the last 100 years. Bubbles/fluctuations/cycles are common and regular in market economies. Luckily, price and growth fluctuations have been significantly muted by government policy since world war II. Just because a few have occurred as of late, does not mean anything has fundamentally changed about humans and their institutions. Yes, much of the financial deregulation of the last decade will most likely be revised. But, the type of grand generalization that he makes seems a bit like the little boy who cried wolf. He then talks about the current fiasco - which, mind you, he has a very good understanding of. However, what he fails to realize is that he is not observing anything original or new. He basically talks through the drama of a Minsky cycle (click me) - a concept that has been thrown around formally since the 50's, but has its roots in economic analysis long before that. Read Stabilizing an Unstable Economy and John Maynard Keynes (both by Hyman Minsky), to get a good idea of Minskian thinking. The media likes to say a lot about the "credit crunch." Some even claim it is the worst financial disaster since the great depression. It certainly has very nasty aspects - but it is nothing like the great depression. It may very well have been far far worse, but the institutions and policy that we have in place (see above comments about advances in monetary theory), have largely helped to ease the situation. He sensationalizes to a large extent. The credit crisis is not paradigm changing. The projected growth of the US economy, though slow by recent standards, is greater than 1%. This does not even classify as a recession by the formal definition. Moreover, the article paints an incomplete understanding of the early 21st century. Fed interest rates were low from about 2001 to 2004 due to the threat of deflation during that period. Deflation is what made the great depression go as far as it did (the public notion that the stock market crash caused the depression is a half truth - the crash triggered psychological shifts about expectations which impacted consumption behavior). Theoretically, if deflation had taken hold, we could be in a very nasty situation today. The article is very good for understanding the mechanics of the credit crunch. But his grasping wildly for broad generalization is just that - wild grasping. Edit: Maybe I'm a bit harsh, but frankly the-media-making-sensational-claims-about-big-stuff starts to be an ear sore. | |

|   | | - Z -

Posts : 2012

Join date : 2007-12-09

Location : Surrounded by primitive screwheads

|  Subject: Re: Per our earlier conversation... (kamma, secondary) Subject: Re: Per our earlier conversation... (kamma, secondary)  Wed May 28, 2008 12:57 pm Wed May 28, 2008 12:57 pm | |

| I'm certainly not as versed in economics as you Dan, but I will say that when I read this article, I felt that the author was using the term "bubble" in terms of the major shifts that have suddenly changed society. These have been relatively rare (perhaps a couple every century), so the author was trying to make the argument that this type of bubble might begin to occur frequently - a very disconcerting proposition (but one that merely reflects the author's opinion). Here's one of the classic works on the "real" bubbles. Very interesting to read: http://www.econlib.org/library/mackay/macExContents.htmlOur current economic predicament is certainly the most dire since the widespread inflation in the 1970s (fact check?). Today is odd because we have inflation mixed with geographically heterogeneous major deflation (real estate). Edit: And maybe I'm a bit naive, but I didn't see this as "the media" making "sensationalist claims." | |

|   | | Galt

Posts : 767

Join date : 2007-12-11

Age : 40

Location : Get Fucked

|  Subject: Re: Per our earlier conversation... (kamma, secondary) Subject: Re: Per our earlier conversation... (kamma, secondary)  Wed May 28, 2008 1:49 pm Wed May 28, 2008 1:49 pm | |

| My bong makes a bubble sound. | |

|   | | Demoniack

Posts : 565

Join date : 2007-12-27

Age : 33

Location : Quebec, Canada

|  Subject: Re: Per our earlier conversation... (kamma, secondary) Subject: Re: Per our earlier conversation... (kamma, secondary)  Wed May 28, 2008 6:25 pm Wed May 28, 2008 6:25 pm | |

| | |

|   | | Kamma

Posts : 378

Join date : 2007-12-09

|  Subject: Re: Per our earlier conversation... (kamma, secondary) Subject: Re: Per our earlier conversation... (kamma, secondary)  Wed May 28, 2008 7:55 pm Wed May 28, 2008 7:55 pm | |

| - - Z - wrote:

- I'm certainly not as versed in economics as you Dan, but I will say that when I read this article, I felt that the author was using the term "bubble" in terms of the major shifts that have suddenly changed society. These have been relatively rare (perhaps a couple every century), so the author was trying to make the argument that this type of bubble might begin to occur frequently - a very disconcerting proposition (but one that merely reflects the author's opinion).

Here's one of the classic works on the "real" bubbles. Very interesting to read:

http://www.econlib.org/library/mackay/macExContents.html

Our current economic predicament is certainly the most dire since the widespread inflation in the 1970s (fact check?). Today is odd because we have inflation mixed with geographically heterogeneous major deflation (real estate).

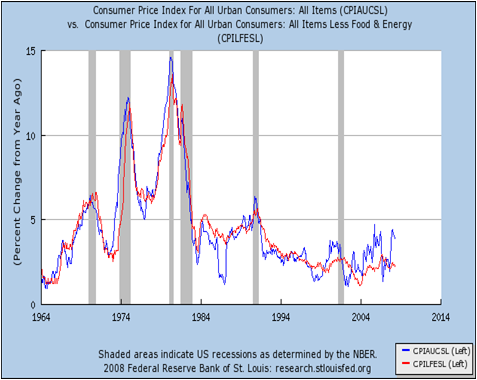

Edit: And maybe I'm a bit naive, but I didn't see this as "the media" making "sensationalist claims." I know that was his argument Z. And in my opinion, he is wrong. Yes the closeness of the Internet Bubble and the current Housing Bubble makes his argument seem correct, but he does not provide a real explanation. Moreover, there are possible explanations for their proximity. For example, the easy money policy of the fed (which was the direct policy result of the Internet Bubble) directly led to the Housing Bubble's inflation. Or, you could argue that the Housing Bubble was a true long term bubble - real estate has regularly inflated/deflated like this - and the Internet Bubble was simply a random technology bubble. The fact that the two were close tells us nothing about the nature of "bubbles" because they were fundamentally different types of bubbles. On the one hand we have significant technological gains rapidly increasing national economic expectations and on the other hand we have rapidly increasing home ownership creating national optimism about "the American dream" (or whatever) creating a real estate bubble. If we had two major real estate bubbles in 10-15 years, then I'd be alarmed. The argument that "this type of bubble might begin to occur frequently" is not founded because a) there is no rationale for why, b) there are plausible explanations for why the two bubbles were so close, and c) there are plausible explanations for why the two should not be juxtaposed. So yes, I know that's what he was saying and that it is just one opinion. I'm saying that it's a rather unfounded claim - in my opinion. On our current economic predicament: Maybe zyzzx. Maybe. In q1 2008 there was about 4.5% unemployment, 0.6% growth, and about 4% inflation. This really isn't that bad. Postive growth is positive growth. I would call unemployment below 6% as being "good." We are not even in a formal recession. Inflation is higher than what the fed has recently been comfortable with. Typically we like to see 1.5-2.5% inflation. To get a sense of how inflation is trending, follow this link for a chart of several measures of inflation expectations. They are rising in some measures. Considering the extremely aggressive rate cuts by the fed, I am not surprised. However, the Great Inflation of the 70's saw inflation rates between 5% and 15%. During this period real GDP growth was about -0.5% to 6%. Unemployment went from 4% in 1970 to 9% in 1975 (and up to 11% in 83 when Volcker weeded inflation out of the economy, creating a recession). In sum, where we stand right now is as good as before the 70's took their course. Therefore, I would not call it the worst economic predicament since the 70's, although where it goes we shall see. I do not have a source, but last I checked growth projections for the next 2 years are in fact positive. And inflation mixed with specific market price deflation is not necessarily odd at all. Also, our current "inflation" is unique. Yes food and energy prices are up, and will probably stay up. However, you need to ask what are the determinants of those prices. Before global markets, too much currency in the US caused inflation of US food and energy prices - now, this effect is diminished. The fact of the matter is that the issuing of dollars by the Fed does not determine global food and energy prices. It would take significant coordination by all the world's major central banks to control worldwide energy/food inflation. But would doing so be economically wise? Most likely the answer is no. Inflation is a problem when it causes distortions because prices do not adjust appropriately, causing mis allocations of resources. Food/energy inflation is not caused because too many dollars are chasing too little food/energy. Food/energy inflation is being caused by too many people wanting too little food/energy. The fact that prices are rising is a GOOD thing - it means markets are working. We may not like expensive food/energy, but it is better than over consumption of food/energy. This is why the Fed is on the fence about inflation. Core inflation (very generally, the CPI minus food and energy, but there are some structural differences too - see me) is actually in a reasonable range. So, are we in a situation? Yes. Is it the worst since the 70's? That's debatable. Edit: And fine, this is "a member of the media" making "sensationalist claims." He makes sensationalist claims because he is purporting a rather significant economic hypothesis with zero econometric analysis, and zero reasoning as to why his hypothesis is true. He simply observes it very loosely and says therefore we MUST be seeing something new. I'm sorry, but that does not logically follow. Randomness does exist. Here are some links to get a sense of the current state of the economy: http://www.bea.gov/newsreleases/national/gdp/gdpnewsrelease.htmhttp://www.intrade.com/partners.jsp?ZID=1375&AID=1&CID=2&page=trade&selConID=508654http://bp1.blogger.com/_djgssszshgM/SAZI3b8kZjI/AAAAAAAAAVI/ZtN8tu4M87w/s1600-h/inudstrial+production.png

Last edited by Kamma on Sat May 31, 2008 7:17 pm; edited 1 time in total | |

|   | | Kamma

Posts : 378

Join date : 2007-12-09

|  Subject: Re: Per our earlier conversation... (kamma, secondary) Subject: Re: Per our earlier conversation... (kamma, secondary)  Thu May 29, 2008 4:50 pm Thu May 29, 2008 4:50 pm | |

| In other news, US gdp growth for q1 2008 was revised up to 0.9%. ( click me) On inflation: click me!On Oil Prices: <<<Clicky>>>A little on the theory behind "core" inflation: click.With a graphic from Krugman's blog (follow the link within the link above - he does an exceptional job illuminating a fairly complex theory): - Quote :

- In the 70s, it was: core inflation quickly shot up after the energy and food price spikes. But this time thatís not happening at all: the rise in inflation is all commodities, with no sign that expectations of inflation are getting embedded in price-setting through the rest of the economy.

In short, this doesnít look at all like the 70s. Inflation is nasty, but itís not getting a grip in a way that will cause it to persist if and when oil and food top out. And it would be a big mistake if the Fed lets fear of inflation distract it from the urgent task of heading off a financial meltdown.

| |

|   | | Kamma

Posts : 378

Join date : 2007-12-09

|  Subject: Re: Per our earlier conversation... (kamma, secondary) Subject: Re: Per our earlier conversation... (kamma, secondary)  Sun Jun 01, 2008 8:55 pm Sun Jun 01, 2008 8:55 pm | |

| Another inflation expectation indicator graphic:  | |

|   | | Sponsored content

|  Subject: Re: Per our earlier conversation... (kamma, secondary) Subject: Re: Per our earlier conversation... (kamma, secondary)  | |

| |

|   | | | | Per our earlier conversation... (kamma, secondary) |  |

|

Similar topics |  |

|

| | Permissions in this forum: | You cannot reply to topics in this forum

| |

| |

| |

|